DOCUMENTATION

-

- Why we created Best Trading Indicator

- Trading frameworks and their timeframes

- How to install a custom indicator on TradingView

- Why the BTI ALgo Global is a MUST for your trading

- Why a Plug & Play system can save you a lot of time and money

- How to update your indicator to be compatible with our Plug&Play scripts.

- Earn recurring passive income with our affiliates program

BEST Algorithm Builder INDICES

Request Your Trial

(⬇️ Please click on the banner below ⬇️)

Introduction

This indicator is available only to our VIP users.

The Algorithm Builder (INDICES) has been and co-invented by us i.e 2 confirmed traders specialized on INDICES trading.

We've been trading Indices days/nights and this is our favorite asset class mostly because it's relatively "easier" to trade than other asset classes (like cryptocurrencies for example).

⚠️⚠️Please note we mostly tested those signals with FXCM broker. You may use a different broker for trading but please make sure to keep your analysis with FXCM (exchange called FX) on TradingView.

We chose a broker where the spreads are among the lowest across the board.

For more information, regarding our packages, please visit our Pricing page

Tutorial video

The Best Trading Indicator trading method

The Best Trading Indicator's 10 Commandments

ALL signals are displayed because they have to be taken

(unless invalidated or risk too big) because we cannot know before what signal will lead to big profits

versus get invalidated.

Those signals were made such as :

- in case of a risk of losing capital, we would lose a small amount thanks to the invalidations/hard exits.

- give only signals where

the Risk:Reward ratio is decent enough, and, the risk shouldn't disproportioned compared to the potential reward.

We're actively monitoring what the competition is doing on a daily basis to stay ahead.

We'll explain below which

market condition is riskier, and how to act (which is better than usually reacting in trading or life in general).

1. You shall read the documentation and watch the video tutorial

Even a bad

trading method with a rock-solid money/risk management could turn out to be slightly profitable. But having a decent trading method and a complete

framework including money/risk/psychology management is even better.

If you subscribe, first we'll be very grateful for your trust and you won't be left alone as we'll build a community around our tools BUT...

we took much time writing the documentation and make those videos because we KNOW what questions most of our customers will have.

If you have the tiniest shred of doubt in your mind, feel free to hit the "Chat with us" button on our website

and also we'll probably answer to the most asked questions via our monthly newsletter + monthly live coaching

2. You shall follow the method religiously and trade like a “MACHINE”.

All graphical elements displayed on the chart by our

indicator is useful (= to be used) and has been thought of, tested and traded with for years.

We know that adopting someone else's method is a huge leap of faith but it's required sometimes to ask our clients to trust us.

Let's answer the 3 previous points here with what we suggest our users to do when using this indicator.

1. 95%+ traders lose on this stock market because they "feel". The market knows what most will feel and will

make its best to make sure they'll feel a certain way before releasing that giant "stop-chasing" wick.

Being a "MACHINE" means trading what we see

whatever we feel/think the market should do or owe us.

2. Using this BEST Algo Globale means not listening to anyone else as we might have opposite signals and this could likely disturb you in your decision-making

process.

3. Getting more conviction and belief in the system by testing it and trading with it with small amounts first and increase the bids progressively. A few only became rich overnight with trading overleveraged

with huge bids during their first trading months and most of those trying to go "too fast" might be humbled by the market.

3. You must always consider the supports and resistances

We know it could be surprising to see so many S/R displayed by the indicator but you'll have to trust us on the following claim : They're all important and must be

considered before entering a trade or not

However, they're not all equally important and that's why you'll see those S/R labels names located at the right of your chart. A monthly S/R is stronger than a m30 S/R - a SMA(200)

is stronger than a SMA(20) etc.

If you ever get a signal near a S/R,

we strongly suggest waiting for a pullback before entering.

Once in a trade, if

we happen to touch a S/R MTF, it's really good practice to set the Stop Loss to breakeven (also called entry price).

Those are reveral zones so it's better to protect our trades whenever we touch one of those S/R.

We then suggest in your position sizing decision making to be pondered using a few items: (we're also doing ourselves for each trade)

1) Does the signal is near a S/R?

2) If yes, how strong the S/R is?

3) If we're about to hit

(or just touched) that strong S/R for the first time, then we know the probability for a short-term reversal is more significant. .It does NOT mean you should NOT

take the trade but it does mean you should wait for a pullback.

A S/R gets weaker the more the candles will hit it - we can deduct then that the first time we hit a strong S/R, it's very likely a reversal

in the short-term could happen.

Please note that we said "very likely" so please don't message us every time you see candlesticks breaking through strong S/R after the first touch - YES! it could happen and will happen many

times for sure... BUT statistically speaking in that scenario, candlesticks bounce back in the other direction way more often than breaking through the first time.

Futhermore, our trading method works for us because we made it such as trading the safer plays more often than the risky plays.

4. You really should NOT change the recommended chart timeframe

5. You Must NOT trade anything else than Indices (Intraday) with the Algo Builder Indices and everything else with the Algo Builder Universal

We offer complete frameworks for all asset

classes:

1.

Algoritm Builder

Indices

2. Algorithm

Builder Universal (for all asset classes)

The full frameworks list and details are available on our Pricing

Plans and Subscriptions pages.

6. You shall know the Leading Trend displayed on your chart

Let's start by 2 quick definitions:

1) Signal in the

same direction of the leading trend: i.e. green signal on a green chart background and red signal on a red chart background.

2) Signal given regardless of the leading trend

direction.

In other words, green/red signal may be displayed on either background color (green/red)

In that scenario, we recommend to wait for a pullback and set your SL to breakeven

quickly.

⚠️ To be clear; ALL signals should be taken but those against the trend could require a pullback as explained above.

We decided not to include the pullback as some might

want entering directly or waiting for it. We'll gather feedback after the product launch and we'll implement what most of us will prefer (inc. a pullback in the code directly whenever the signals given are against the trend).

The leading

trend (background color on your chart) is based on a smoothed indicator and has to be seen as your trading compass. The color background also means:

- (not mandatory) reducing the position sizing

- (mandatory) wait for a pullback.

You'll miss a few trades that way but what's worse between missing a few potential good trades and losing too often because one wants to click and takes all signals?

PS: It's a rhetorical question - we already know

the answer ^^.

However, fear not (too much) friends we offer this solution because we think it could work for most of you and make some nice gains if you follow our rules - that we apply to ourselves for every trade.

Even if

you don't use this framework at all, all the trading rules we give are valid

(= understand should be applied) for any trading method.

7. You shall know your trading profile

We won't make any detailed guidance here because we don't know you personally as well as you know yourself.

Trend

confirmation when entering against the leading trend: You'll also notice that the leading trend is real and strong. Let's assume a trader enters in a LONG position/RED background and then the chart background turns GREEN at some point

later on. You'll often see that this "event" will confirm even more the trend

direction and that's when the trend could very likely accelerate.

Using the "against

the leading trend" signals make us entering earlier but requires more trade management (= can't get more gains without taking more controlled risk).

8. You will embrace the Hard Exits philosophy

For the 1. Algo and S/R exit mode, the hard exits are to

be understood as stop-loss for that mode only. We based those exits on a smoothed multi-timeframe indicator.

This hard exit includes a proprietary stop-loss + trailing stop already.

We designed it such as to exit with

a small loss before a reversal will happen.

The framework won't work as well as expected without it.

It's even the most important "commandment" and it requires to be rigorous, and throw away to the bin whatever we might think and

feel.

Not exiting a signal when invalidated because

you feel differently will not work.

We'll probably get tons of private messages with screenshots from our clients showing us the rare few times where they ignored it, and it worked but we

won't hear from them anymore when their personalized redesigned trading framework won't work

anymore.

9. You must know the Risk and Money Management basis

Each market is unique and cannot possibly be traded the same way.

We're happy to provide a few guidelines for the STOCK market just below:

1- Mind the time of the day: Why trading when no one else is trading? This

means there likely won't be enough volatilty to bring interesting opportunities. Then, we wouldn't set a

trade on a US STOCK right before the end of the trading afternoon session or right before

the weekend/holidays

Last example: at night or before the weekend, or before important

bank holidays (Christmas, New-Year's Eve, ...). Big players take their time off seriously - taking also

their trading money off the market - and so should we. We better follow their lead instead of

dealing with annoying trading ranges.

2- Stay consistent with your

position sizing: it's not because you won a few trades in a row that you should increase the

position size - this is actually the best way to give back what you earnt, and we believe most of our

customers use our services because they gave back too much. (YES! we know!).

3- Stay

consistent with your trade management: each S/R with a big timeframe is a TP zone. Whatever you

think/feel, when in a trade and the candlesticks will hit once of our S/R you can either:

- set your

SL to breakeven

- set your SL to breakeven and take a bit of profit. (Up to you to decide which

percentage)

Very important note: the hard exits are a crutial part of our trade

management methodology.

4- Trailing Stop: The BEST Algo Globale

includes our Trade Manager with a trailing stop based on percentage or pips value.

This is very good practice to start trailing your stop, once an opportunity gave you enough profit.

When it happens, we usually set at least our stop to breakeven so as to not losing anymore.

Hoping,

then that the opportunity will get bigger, and the trailing will follow the price movement, protecting our

gains and preventing us from even losing/giving back to the market.

9.bis Can you or can you not plug that system into an automated bot?

Are we any different? Maybe yes maybe not, only you can judge. Our system is made on a very custom BEST Algo Globale and if you know those indicators, you also know that we can adjust our system whenever it won't work anymore and it won't take us more than a few hours/days for adjusting it to new market conditions.

There's

always someone in the team trading the index market with the tool to make it still works so rest assured that you'll never be left alone. You might have bad trading days but will

rarely get bad quality signals - assuming you follow our framework like a "machine".

The commandments will never change, but sometimes the internal computations in the code might change if we find areas of improvement and we'll

do so at our own discretion whenever we know it's the right time to do some major updates.

And even if you decide to plug our Algo Builder frameworks to automatize the entries,

it's utopic to believe you shouldn't monitor. We know you can capture the TradingView alerts (entries, hard exits, stop-loss, take-profits) and send them out to your broker but at least... it should be monitored because so many

things can go wrong and not even related to our indicator (network connection issue, third-party issue, broker API issue, Donald Trump tweets, ...)

10. You Shall Test and Make your Own Conclusions.

You have a few weeks to test for free because we know that many traders aren't full-time traders and have a family/job/life outside trading.

So take your time to backtest visually the signals, trade with small positions,

follow our rules and learn from your own experience.

While we keep saying "do this, do that", we're not dogmatic at all and we welcome any

feedback you might have that could benefit the community and we'll likely integrate it if we see a good value in your idea.

You can submit any idea/feedback/comment via our discord channel or using the "CHAT WITH US" button.

Some might find our offering expensive but you're paying for 7

years of trading experience/tests/sweats and tears served on a golden plate and we hope your trust in us will reward you handsomely.

And we analyzed the competition thoroughly - we know most of them and tried their offering

- we're way cheaper and hopefully we'll bring some value to your trading. We will judge our value based on your trading performance and received feedbacks.

Adding that we think we're better than everyone else won't help

because every legit company thinks they're the best at what they do.

Recommended Stop-Loss and Take Profit(s)

Stop Loss

The embedded stop-loss is those brown vertical bars; symbolizing the hard exits.

Even if you set your own stop-loss using the Trade Manager, we must

respect the hard exit.

This exit signal primes over anything else. It's based on an indicator basically saying that the price could reverse deeper; then a proper risk management implies to exit whatever we think should or shouldn't

happen.

Take Profits

Take profit zones: The Algo Supports & resistances

They aren't only here to be used as safeguard, and entering on a pullback.

They're also taking profits levels - because the price will touch, and could very likely reverse afterward,

at least during a short-term period.

We (and absolutely no one on earth) can know

before, if a reversal will be violent or not.

As a safety measure, we

always assume the reversal will happen, and a bit before the physical contact between the price and S/R to:

- set the Stop-Loss to breakeven/entry price.

- and/or take a bit of profit.

In the short-term,

it might limit slightly gains coming from a few lucky

trades only.

Though, in the long run, this methodology is thought, and designed to protect a trader capital from going

downhill.

Last words before the input fields section...

This framework includes the entries, user defined stop-loss, our take-profit zones, hard-exits (those are crucial and must not be ignored).

This system, is by far, one of the most complete semi-automated systems

for trading, ever made on TradingView, and offered to retail traders. 👍👍👍(#bold #statement)

Our professional trading and quant experience was put to good use, to system generally used by professional traders, and made it easy to use for our customers.

Daily signals shared once a day

The user input fields

ACCESS KEY

Here you'll need to insert the access key you received by email (within 2 business days after the date of order) This key has been generated for you according to your subscription package and have a specific expiration date included in it.

If the key inserted is incorrect or expired, the indicator will display an orange label inviting you to subscribe again

Profit/Loss and Risk/Reward Panel

The Panel will display (if selected) for the current trade only the PnL (Profit and Loss) and R:R (Risk to Reward) data. We let you the ability to position the panel whenever you want in the chart - you'll only have to play with the X and Y positions to get it displayed wherever you want

Trade Manager and Pnl Panel

The Trade Manager Panel will automatically adapt to the values you'll set for the stop-loss and take profits.

The fields are more or less the same as explained above and pretty self-explanatory. We review some of them in the video tutorial

also.

Standalone Trade Manager (Plug & Play)

Stop-Loss Management

Take Profits Management

You can manage up to 2 take profit levels based either on percentage or price value target.

- Percentage: for instance, setting the % TP1 to 2% will set the TP1 level 2% away from the entry price.

- Price value: for instance, setting the value for Bitcoin TP1 target 10000, sets the TP1 level at that price level.

- Distance value: for instance, setting the value for BTC/USD TP1 target 200, sets the TP1 level 200 USD away, from

the entry price.

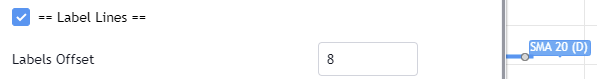

Labels Lines

Session hours filtering

It's important to note the hour's filter is based on the broker timezone - not on your chart timezone. If your chart is set in UTC+2 but you're displaying the price data from NASDAQ:TSLA then the real timezone used is UTC-5.

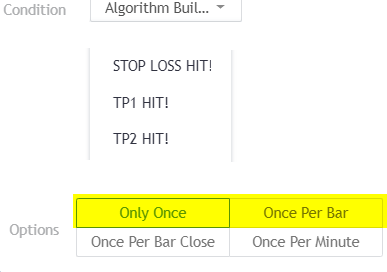

🔔 Alerts 🔔

The screenshot should be self-explanatory enough

You mandatory need to create 1 alert for the BUY event and 1 alert for the SELL event

The Algorithm Builder allows to capture the alerts on those BUY green triangles and SELL red triangles.

You'll have to create 1 alert per event (buy or sell) per asset (BTC, DOW, APPL, ...) per timeframe (m5, m15, ...).

For instance, if you add your Algorithm Builder to your chart. You have to create 2 alerts. A first one to capture the MAIN BUY event, a second one to capture the MAIN SELL event.

According to your TradingView subscription type, you might receive the alerts by email and by SMS

Hard Exits alerts

Trend Manager alerts

You'll be able to create alerts based on our Trade Manager. It's recommended to wait to be in a trade, and after creating the Trade Manager alerts.

As we could recommend to trigger the BUY/SELL alerts on candle close

(for more security/less risk for fakeouts), it's generally a best practice to set the Trade Manager alerts using the

We mean, once the SL/TP1/TP2 are hit, you might not want to wait for the candle close to act, because it could be too late, and very often won't be in the trader favor.

🔔 Dynamic Alerts and TradingView automation 🔔

Here are the list of third-parties capturing TradingView alerts and forwarding them to compatible STOCKS brokers.

Anyway, we're talking about SWING trading here with trades lasting days/weeks. Automation may not bring a huge extra values when the

trading timeframe and methodology aren't giving much signals per asset.

The process to connect the Algorithm Builder entries/exits signals to those systems is fairly easy.

You'll find more insight to make your alerts compatible with those

systems here.

Request Your Trial

(⬇️ Please click on the banner below ⬇️)