DOCUMENTATION

-

- Why we created Best Trading Indicator

- Trading frameworks and their timeframes

- How to install a custom indicator on TradingView

- Why the BTI ALgo Global is a MUST for your trading

- Why a Plug & Play system can save you a lot of time and money

- How to update your indicator to be compatible with our Plug&Play scripts.

- Earn recurring passive income with our affiliates program

Algorithm Builder - Single Trend

Request Your Trial

(⬇️ Please click on the banner below ⬇️)

Introduction

The Algorithm Builder - Single Trend was made to detect the convergence of many unrelated indicators, and give a BUY or SELL signal whenever all the selected sub-indicators are converging in the same direction

Video Tutorial

The user input fields

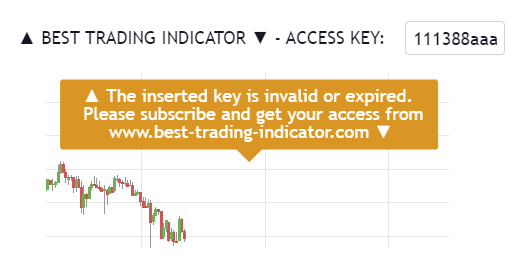

Access KEY

Here you'll need to insert the access key you received by email (within 2 business days after the date of order) This key has been generated for you according to your subscription package, and have a specific expiration date included in it.

If the key inserted is incorrect or expired, the indicator displays an orange label inviting you to subscribe again

Utilities

Algorithmic Supports and Resistances

If you want to select/unselect specific supports/resistances, you'll need to :

- Go to the Style tab

- Select/Unselect the ones that make sense to YOU according to asset/timeframe on the chart

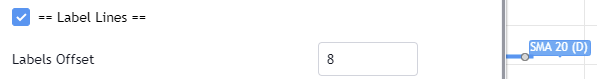

Labels Lines

Indicators

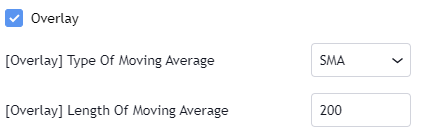

Overlay

The Overlay gives a bullish signal if the price closes above the selected Moving Average. Otherwise, the returned signal is bearish

Supertrend

The Supertrend gives a bullish signal if the price closes above the red supertrend for the first time. Otherwise, the returned signal is bearish

MACD or MACD ZERO LAG

You have the option to choose between a standard MACD or its alternative called MACD Zero Lag (known to be more reactive/less lagging that the standard version). There is no right or wrong choice here, all depends on your own trading strategy. The MACD or MACD Zero Lag gives a bullish signal if the oscillator goes positive for the first time. Otherwise, the returned signal is bearish

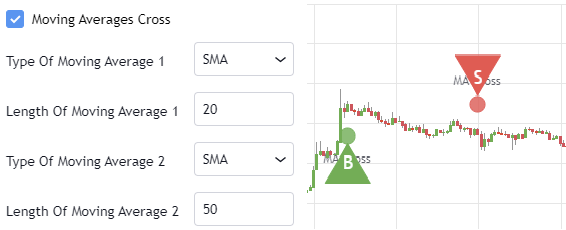

Moving Averages Cross

The Moving Averages cross bullish signal whenever the 2 selected moving averages cross for the first time. Otherwise, the returned signal is bearish

Price versus Ichimoku Cloud

The Price versus Ichimoku gives a bullish signal whenever the candle closes above the Ichimoku cloud. Otherwise, the returned signal is bearish

Trend Code

The Trend Code is part of our internal formula, and we cannot disclose what it is exactly. However, we'll surely tell you how to use it. As a rule of thumbs, the lower the input value is, the lesser the number of trend codes is - the higher the input value, then the trend code will be more smoothed, and gives less sub-signals. (This is the classical behavior of any indicator anyway)

Pullback Value and Pullback Percentage

Pullback Value: the indicator expects a distance from the selected moving average in lots/units (i.e. Pullback Value SMA 20, and buffer 3 accepts the pullback whenever all the signals are converging, and the current price is 3 units/lots away from your SMA 20

Pullback Percentage: the indicator expects a distance from the selected moving average in percentage (i.e. Pullback Percentage SMA 20, and buffer 3 accepts the pullback whenever all the signals are converging, and the current price is 3 percent away from your SMA 20

Hard Exit (based on MACD)

Let's assume the simple configuration with a SMA 20/50 cross, and a Supertrend (5,5). The signal is bullish signal whenever the 2 selected indicators are converging. Otherwise, the returned signal is bearish

This vertical brown line appears because (in that specific scenario) we're in a BUY, but we get a hard exit/invalidation signal based on that MACD. This allows to exit a losing trade sooner, and before it might hit your stop-loss

Alerts

The screenshot should be self-explanatory enough

You mandatory need to create 1 alert for the BUY event, and 1 alert for the SELL event

The Algorithm Builder - Single Trend allows us to capture the alerts on those BUY green triangles, and SELL red triangles.

You'll have to create 1 alert per event (buy or sell) per asset (BTC, DOW, APPL, ...) per timeframe (m5, m15, ...).

For instance, if you add your Algorithm Builder - Single Trend to your chart. You have to create 2 alerts. A first one to capture the BUY event, a second one to capture the SELL event.

According to your TradingView subscription type, you might receive the alerts by email, and by SMS

Request Your Trial

(⬇️ Please click on the banner below ⬇️)