Introduction

Have you ever heard of the "Brrrr" term?

Let's see what the "money printing" is about and its consequences.

The Federal Reserve

This is the United States of Amerca central bank charged of helping the economy and local banks (JP Morgan, Bank of America, CitiGroup, Wells Fargo, ...)

Created in 1913 for the purpose of central control of the monetary system in order to alleviate financial crises

They played a major role during the 1930's Great Depression and the 2000's Recession

As of today (September 21st, 2020), the FED is led by Jerome Powell.

The FED chairman and vice-chairman are named by the US president and confirmed by the Senate. They serve a term of four years.

Is the FED useful for the average Joe?

The FED is "supposed" to use tools (inflation, interest rates, ...) previously allowed by the US Congress. It's a myth that the FED acts without supervision

From 1913, it went downhill, to say the least. Whenever, we involve bureaucrats to control our fiat store of value, this gets ugly.

As a direct consequence, the fiat currency value decreases progressively over time

Quantitative Easing

Quantitative Easing (or QE) is a monetary policy used by the FED to issue loans to local banks in order to purchase their securities (stocks, bonds, ...)

The goal is to expand the economic activity. Used when inflation is very low and the last resort when all the other monetary policies aren't working.

And unfortunately... they're clearly not working.

Contrary to popular beliefs, The FED goal is the Deflation (and not inflation).

They always speak in term of inflation but that's not by choice. For an economy to prosper, they should increase the buying power of each dollar.

They're failing at every step of the way and ended up with a dollar decreasing in value since 1913.

Maybe we would have been better off without central banks - only with a FREE market (who said decentralized :))

While it's true that our groceries shopping seem to be more and more expensive, Inflation isn't and shouldn't be measured in term of the everyday commodities we purchase.

Inflation is a very complex concept. While our groceries fees increase on one hand, we can apply for attractive loans at a very low-interest rate

Inflation versus Deflation

Disclaimer: We all act based on a fraction of available information.

If you can predict if Inflation or Deflation will happen next, you'll be in a very good spot to make sound investment decisions.

There is a huge debate now to understand whether Quantitative Easing increases or decreases the M2 money supply.

In this blog, we'll try to figure out if the QE adds or removes liquidity out of the system. There is not a definite answer yet to this question, though we already can make solid analyses.

Inflation case

Inflation means the M2 money supply increases as the FED keeps injecting magic fiat currency into the economy.

Deflation case

Deflation means the M2 money supply decreases as the FED issues digital loans to the local banks. The keyword here is "digital".

In this scenario, the FED doesn't print anything. But, the local banks have to refund those loans at some point with fiat currency right?

Meaning some fiat currency leaves the economy to reach the FED balance sheet.

Hence, the M2 supply decreases and we're talking about deflation.

Purchase of Treasuries

Assuming we're in a Deflation, then why the stocks, commodities, cryptocurrencies are increasing in USD value?

Simply put, the FED also buys stocks directly to support the "economy".

Though, it's quite obvious now that the system they're really supporting is the financial system more than the economy. The USA pension funds are private (401K) and mostly invest in US securities such as stocks, bonds, ETFs...

Whenever US residents add some contributions in their 401K, those pension funds, ETFs are obliged to purchase securities in order to fund their customers' accounts.

We reached now a massive speculative bubble where people lost confidence in their govenrment, the FED, and the dollar. As the dollar decreases in value, they're forced to take more risk in the markets to at least maintain their quality of life (and in the worst case to put food on their table).

Conclusion

Based on all those elements, I really don't think right now we witness an Inflation (or Hyper-Inflation) but a Deflation.

No one can predict the future and I don't have a crystal ball. We totally can shift to inflation or hyperinflation later.

For now, we're in a new paradigm that only a few understand.

Those counting on their dollars to appreciate in value and improve their lifestyles without investing (= taking some extra risk) are going to have a bad time.

There is no other choice to edge against this central authority by purchasing assets that usually keep going up during times of crisis (Gold, Silver, Bitcoin, Real-Estate, ...)

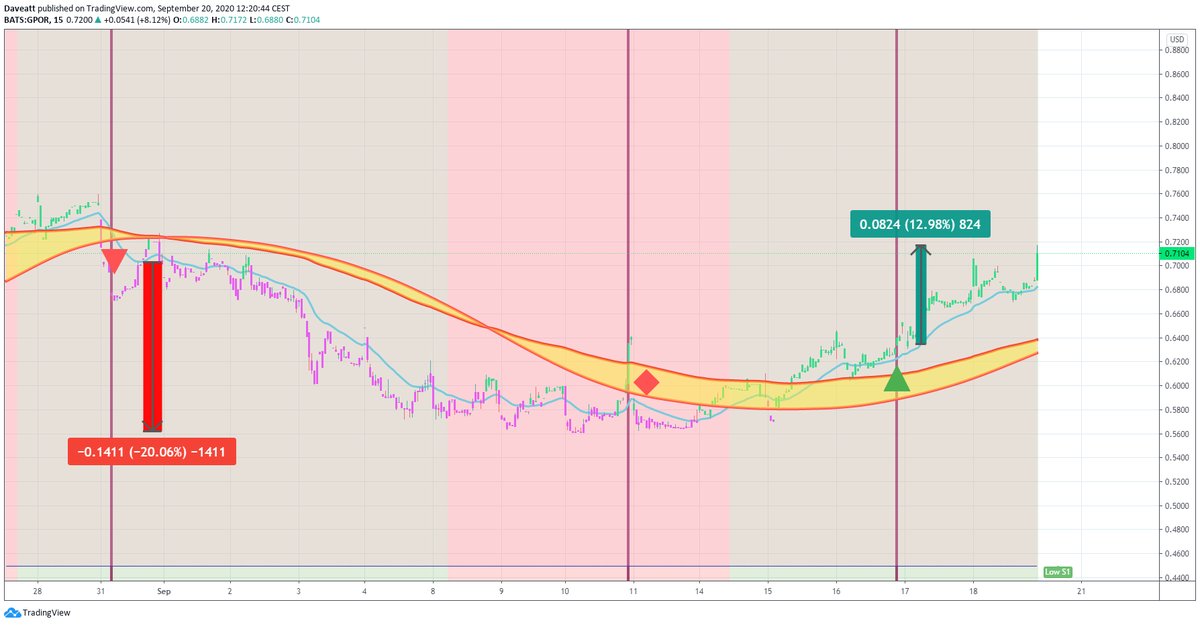

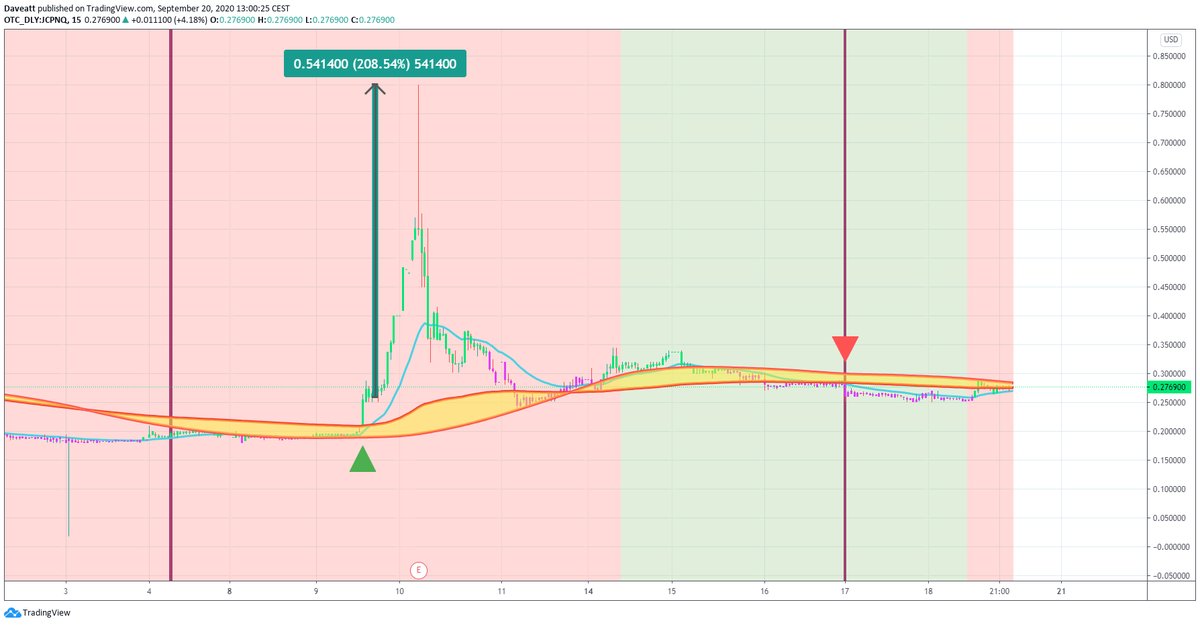

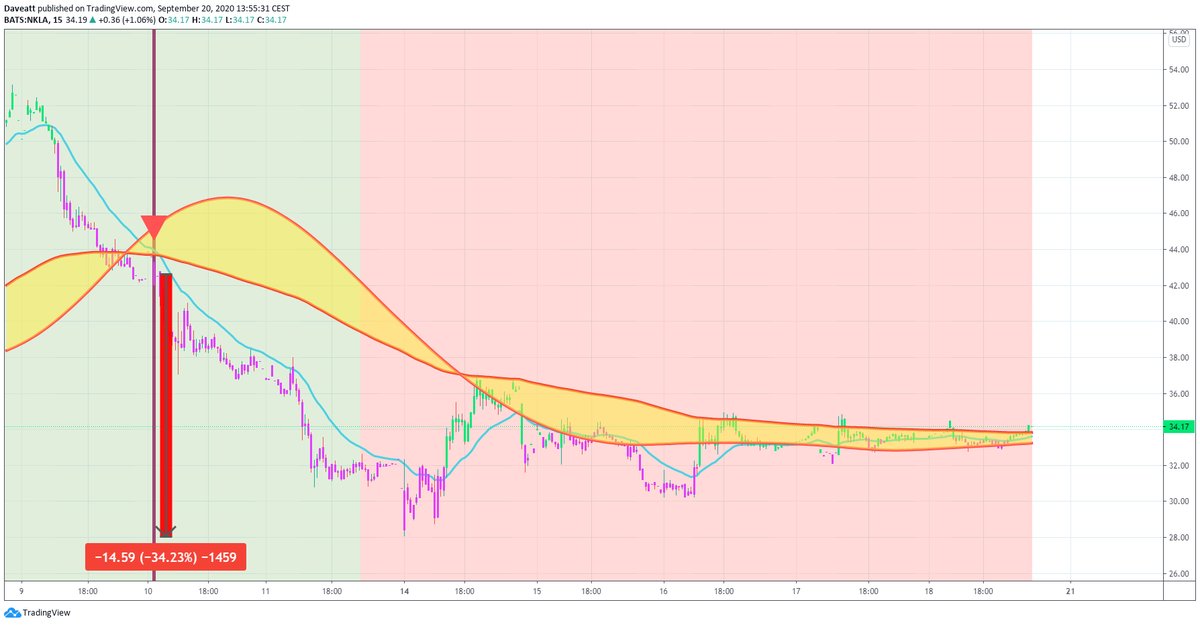

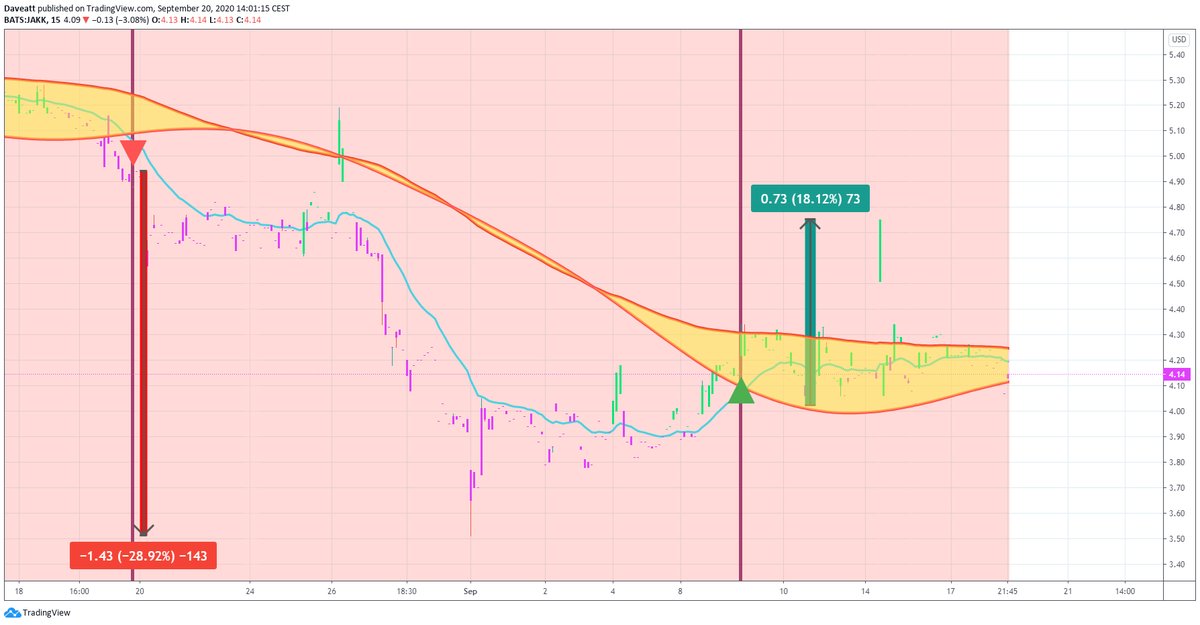

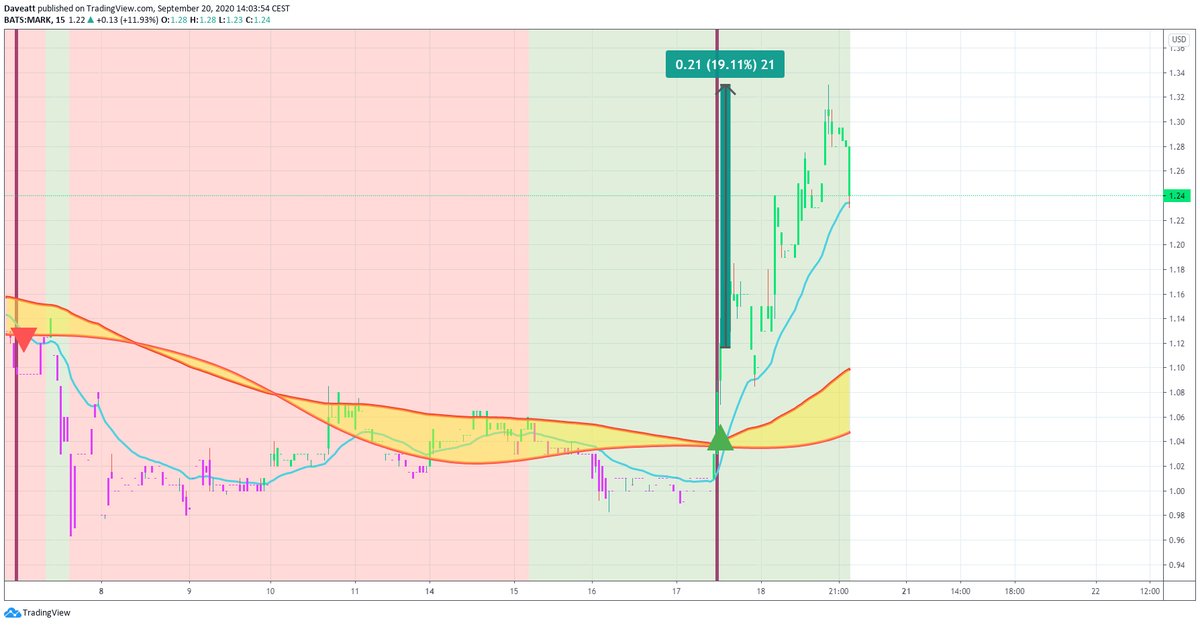

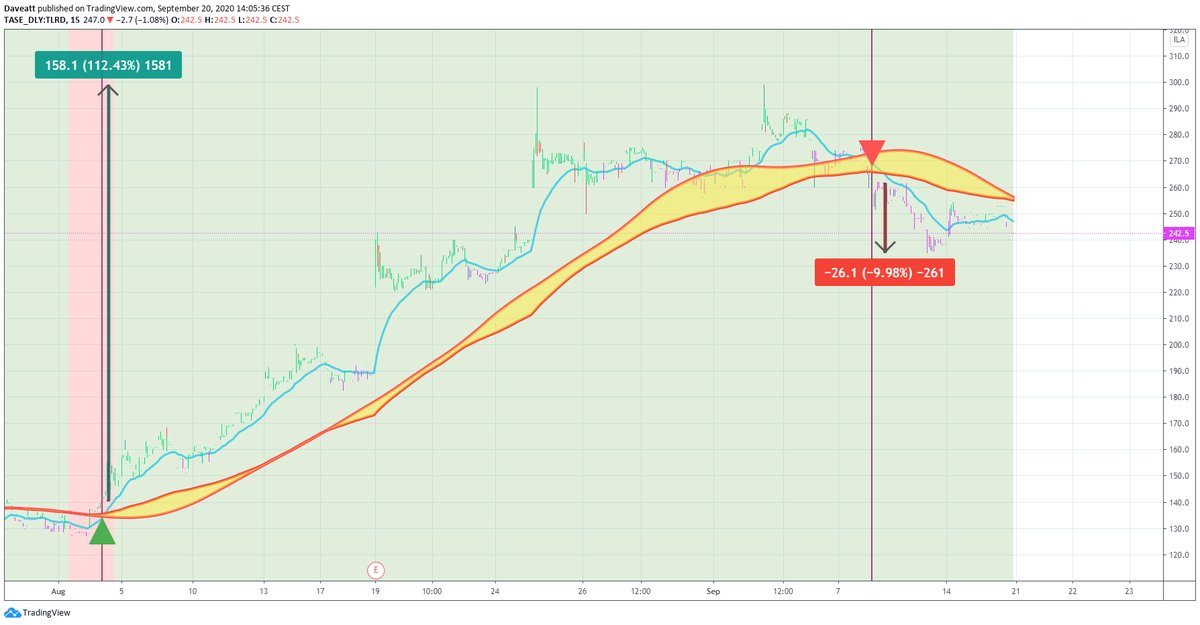

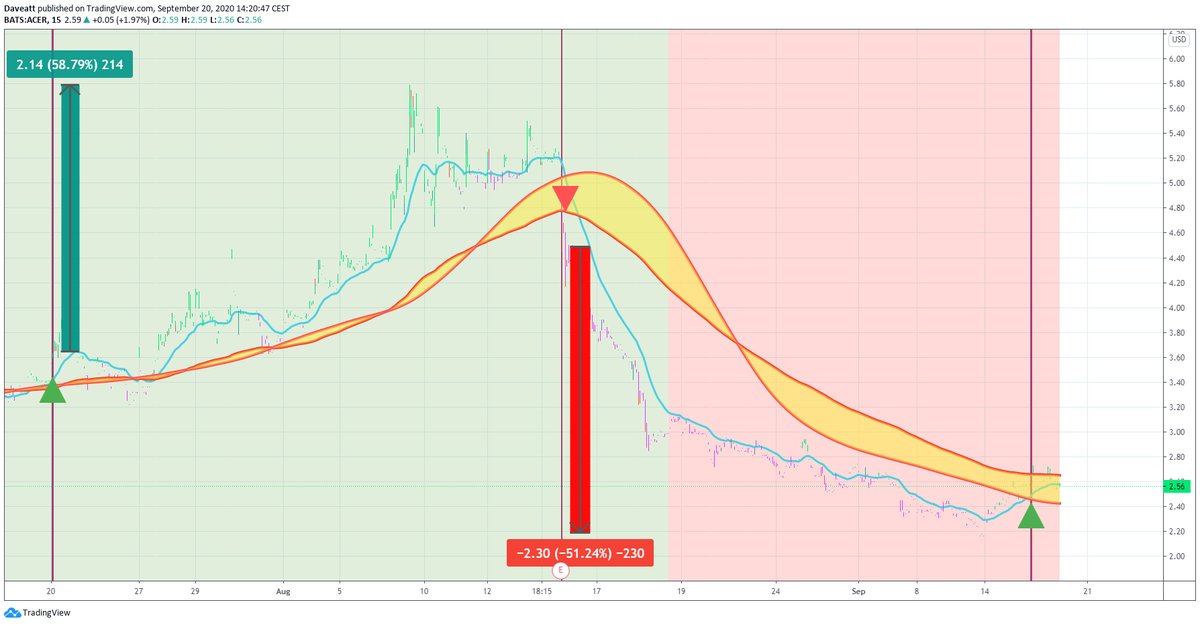

Our recent Stocks trades shared on Discord and Twitter

A quick note

Each screenshot below is clickable and can be enlarged for better visibility

Leave a comment