Pricing plans and indicator

Trading the Camarilla Pivots

Camarilla Pivot Points is a modified version of the classic Pivot Point.

Camarilla Pivot Points were introduced in 1989 by Nick Scott, a successful bond trader.

The basic idea behind Camarilla Pivot Points is that price has a tendency to revert to its mean until it doesn’t.

What makes it different than the classic pivot point formula is the use of Fibonacci numbers in its calculation of pivot levels.

Camarilla Pivot Points is a math-based price action analysis tool that generates potential intraday support and resistance levels.

Similar to classic pivot points, it uses the previous day’s high price, low price, and closing price.

Camarilla Pivot Points are a set of eight levels that resemble support and resistance values for a current trend.

These pivot points work for all traders and help in targeting the right stop loss and profit target orders.

C = Previous day’s close

H = Previous day’s high

L = Previous day’s low

R4 = (H – L) x 1.1 / 2 + C

R3 = (H – L) x 1.1 / 4 + C

R2 = (H – L) x 1.1 / 6 + C

R1 = (H – L) x 1.1 / 12 + C

S1 = C – (H – L) x 1.1 / 12

S2 = C – (H – L) x 1.1 / 6

S3 = C – (H – L) x 1.1 / 4

S4 = C – (H – L) x 1.1 / 2

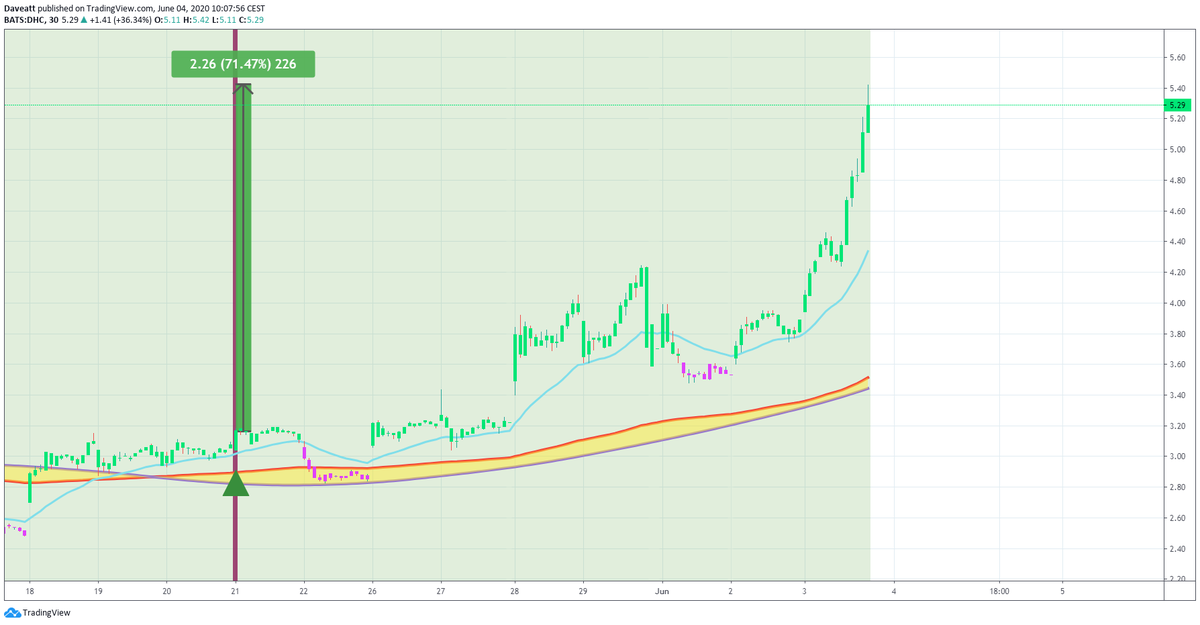

We're trading Stocks Options with the Algo Builder Crypto Intraday 5-minutes and Algo Builder Stocks 30-minutes

A quite note

Each screenshot below is clickable and can be enlarged for better visibility