What Are Circuit Breakers?

Circuit breakers are regulatory measures to temporarily halt in trading on an exchange, which are in place to curb panic-selling. They apply both to broad market indices such as the S&P 500 as well as to individual securities and exist in the United States as well as in other countries.

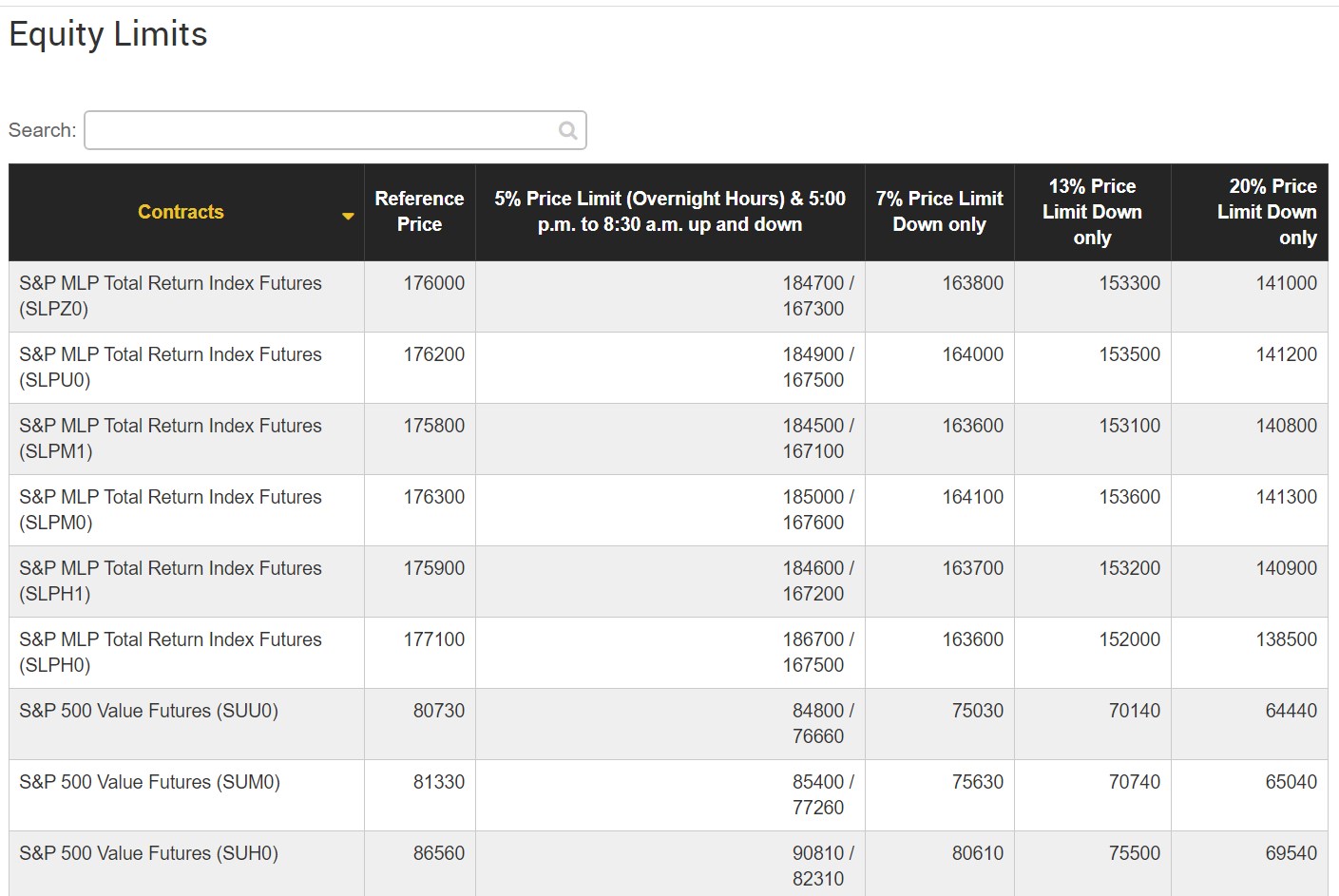

Circuit breakers function automatically stopping trading when prices hit predefined levels, such as a 7%, 13%, and 20% intraday move for the S&P 500. Circuit breakers a form of market curbs.

As recent examples, on March 9, 2020, and again on March 16, circuit breakers were triggered at the NYSE as the DJIA fell more than 7% at the open, amid the growing global coronavirus pandemic.

We also witnessed in March 2020 that US indices and futures halted trading even after a -5% or +5% daily move

Limit Down and Limit UP

The SEC has used a “limit-up limit-down” (LULD) mechanism to determine the thresholds for acceptable trading.

In this framework, halts are triggered by up-or-down moves outside of certain bands, determined based on the security’s price and listing.

What happens if you are trapped when the limit-up or down activate itself?

You should not be trapped and always check the link below every day

When the Daily candle is about to reach the limit UP or DOWN, exit your trade(s) no matter what.

Where to check the up-to-date circuit breakers limits?

Source: https://www.cmegroup.com/trading/price-limits.html#equityIndex